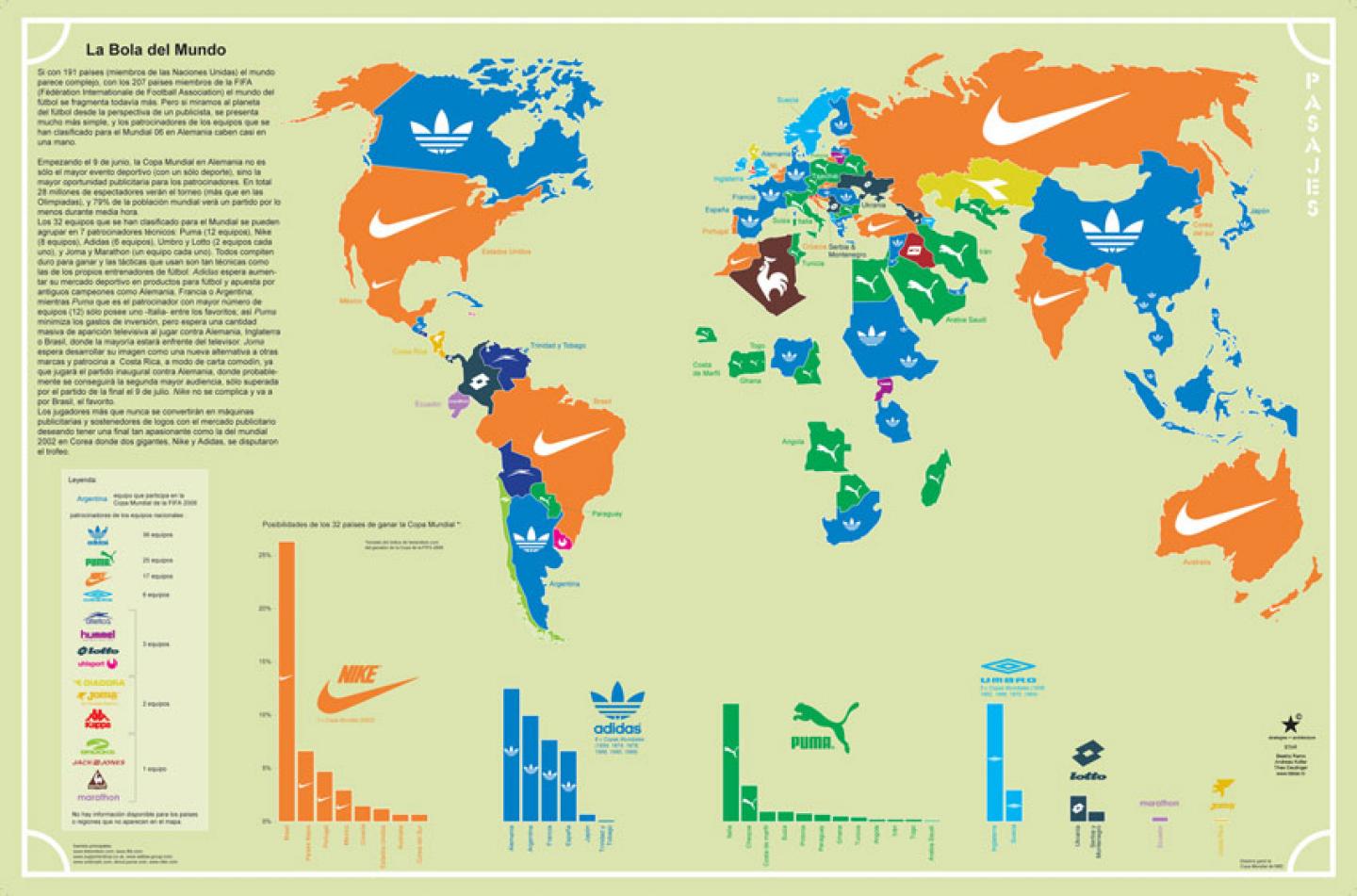

With a multitude of 191 countries (UN members) the political world seems to be complex but with currently 207 members of the FIFA (Fédération Internationale de Football Association), the world of soccer appears to be even more fragmented. Yet if one looks at this soccer-planet with the eyes of an economist, it presents itself much simpler given that the most powerful teams with a valid chance to win this years Soccer World Cup can be subsumed into a hand full of sport brands.

Starting on 9th of June, the World Cup in Germany is not only world’s biggest single sports event it is also the biggest branding opportunity for sponsors. 28 billion spectators will watch the event, and 79% of the world population will watch at least one match for more than 30 minutes.

The 32 teams who made it into the tournament can be summarized to a total of 7 technical sponsors: Puma (12 teams), Nike (8 teams), Adidas (six teams), Umbro and Lotto (two teams each), and Joma and Marathon (one team each). They all compete hard to win and the strategies they followed are as technical as the ones used by the football coaches: Adidas hopes to extend its market share in football products by sponsoring past winners like Germany, France or Argentina while Puma got the most teams (12) with only Italy as real favourite; in this way Puma minimises the investment costs, but aims with quantity for a massive TV exposure by playing against Germany, England or Brazil. Joma hopes to develop its image as the ‘alternative brand of choice’ and counts on the impact of its ‘only child’ Costa Rica, playing against Germany in the opening match which will probably get the second largest audience just surpassed by the final. Nike makes is simple and goes for the favourite Brazil.

Players become brand machines and place-holders for logos with the economic world looking forward to a final match as exciting as in the 2002 World Cup in Korea between the two giants Nike and Adidas.

2006